Calgary Real Estate Market Outlook 2024

Several dominating themes emerged in 2023 that had a significant impact on the Canadian housing market. We will dive into these core themes - detail how they impacted Alberta and Calgary specifically in 2023 and suggest how their trajectories will steer us in 2024. For initial context and perspective, the Calgary Real Estate Board predicted a roughly 6.5% increase in prices across all product types in 2024 – with detached homes increasing 4%, condos increasing 9.5% and semi-detached 5.5% and row 9%.

MIGRATION

In 2023, Alberta experienced some of the highest migration levels on record. This consisted of both international immigration and interprovincial migration. In total, Alberta’s population grew by 4.3% in the 12 months preceding October 1st (which is the latest statistical data that is available from the province). In the third quarter alone, Alberta’s population increased by 1.3% adding 56,306 (36,212 From international immigration and 17,094 from interprovincial migration). The interprovincial migration doesn’t tell the full story as the actual figure of people that moved to Alberta in Q3 was 29,129; however, the way migration is calculated is amount of people that moved to Alberta – minus the people that left the province. The total moving into the province was 6.9% lower than the third quarter of the previous year but the number of people leaving the province also dropped by a larger number (11%) meaning less people are leaving the province. Calgary is anticipated to account for over 50% of the growth seen by the province, as it did in 2023. The Calgary Real Estate Board is anticipating that the population increase in Calgary will slow down in 2024, dropping by roughly 1% from 4.7% in 2023 to 3.6% in 2024.

CHART | CANADIAN IMMIGRATION HISTORY

There are rumors that Q4 numbers will be equally strong with international and net inter-provincial migration. The federal government has brought in regulations aimed at alleviating housing availability, but these will have little impact in the near term as they don’t anticipate decreasing overall immigration targets much below what we have seen in the past few years beyond 2026. Current immigration levels have nearly doubled over the last 8 years putting a major strain on housing costs across Canada.

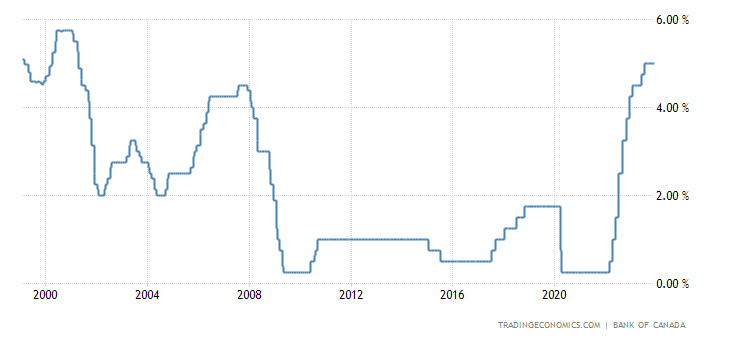

INTEREST RATES

Q3 2023 saw the first pauses to increasing mortgage rates since early 2022. 10 consecutive rate hikes brought rates to heights not seen for 25 years, taking rates from 0.25% in February of 2022 to 5% which they have held since July of 2023 in one of the fastest rate hike cycles in history. This large increase in rates has put a strain on households, especially those who are renewing or have been riding the increase with a variable rate mortgage. Mortgage costs have increased or are anticipated to increase as much as 40% for those who purchased or renewed at the bottom in 2020. This disparity between rates is keeping many people on the sidelines, both sellers - because it is hard to move up and qualify for a more expensive home with the increase in rates - and buyers, who are waiting for their purchasing power to increase and their monthly payments to fall. This has certainly wreaked havoc on supply and demand dynamics.

CHART | CANADIAN INTEREST RATE HISTORY

Initially interest rates were anticipated to fall by April 2024 but the chances of this are decreasing due to sticky inflation figures just released showing inflation at 3.4% - a slight increase from the previous month and bucking the trend that the Bank of Canada would like to see before they decrease. Alas, we are likely looking to the end of Q2 for any change in rates in the June 5th announcement. The spring market will factor in the anticipated decrease with purchasers potentially opting for a longer possession so they can capitalize on rate reductions in June. Although we anticipate a strong spring market this could potentially delay the flurry of activity and extend into the summer months.

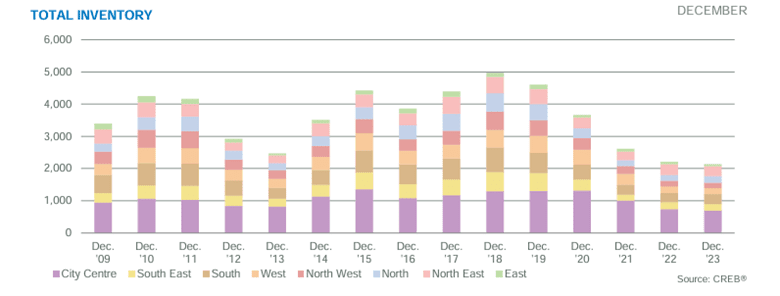

INVENTORY

Inventory in Calgary has been declining over the past four quarters and finished the year on average with a roughly 30% decline year-over-year – and this is coming from a year that already had historically low inventory levels. Both detached, semi-detached and row experienced a decrease in sales by 20,10,11% respectively but the decrease in inventory mitigated any price declines and drove prices up in all quadrants and segments. Apartments showed a decrease in inventory of 20% while also experiencing an increase in sales of 27% reflecting price increases in the range of over 13% in 2023. The increase in prices brought the prices close to all time highs experienced in 2014, however, there are still segments of the market (notably inner-city) that are still 5-10% below those levels. The real estate board is predicting a 9.5% increase in condo prices in 2024 which should bring most condo prices to new heights.

CHART | CALGARY INVENTORY HISTORY

As we start 2024 we are entering with some of the lowest inventory levels in history. A search for active properties in Calgary metro area shows only 1622 properties currently active and for sale (as of end of January). A search for sold properties in the last 30 days to establish how many months of inventory there are shows 1594, now while this doesn’t include properties that are currently conditionally sold (572) it represents a declining inventory level both month-over-month and year-over year. The market in all segments in Calgary is entrenched in sellers’ territory and current inventory levels will likely push up pricing higher than predicted by the real estate board if they trend in a similar trajectory.

OTHER MARKET OBSERVATIONS

Other micro trends that could impact pricing and purchaser intent, are, regional price disparities, zoning relaxations, and short-term rental regulations.

INNER-CITY STILL UNVERVALUED

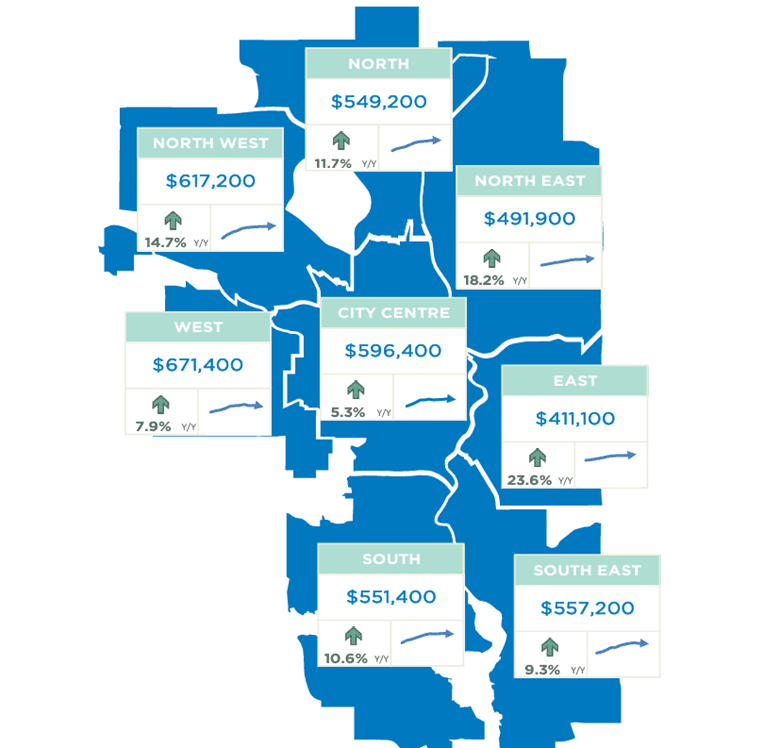

The most substantial gains in Calgary were in the more affordable inventory regions in NE and East with 18.2 and 26.2 percent increases respectively. This speaks to the affordability factor as these quadrants were the most affordable, and potentially also to the demographics of recent migration. The city centre had the lowest levels of increase at 5.3% leading me to believe that is currently undervalued. The covid era saw an exodus from inner-city that should start to reverse course.

CHART | CALGARY PRICING INCREASES 2023 BY QUADRANT

ZONING CHANGES

The City of Calgary, as part of their “Home is Here strategy” directed Administration to take actions to address the housing crisis. One of these actions is to propose citywide rezoning to a base residential district, to allow for single-detached, semi-detached, rowhouse, and townhouse homes on parcels that currently only allow for single – or semi-detached homes. To accomplish this, The City is looking to rezone properties to R-CG, R-G and H-GO. It will likely take the year to fully approve through council as they need to run through the usual red tape and consultations, but I anticipate we will follow-suit with Edmonton whose changes came into effect January 1st 2024. This substantially increases the density that can be built on most residential lots in the city. They City of Calgary is hoping to garner attention from the federal government and the Housing Accelerator Fund for cash to support increased housing development. We believe that long-term these zoning changes will increase demand for primarily single family detached dwelling neighbourhoods and drive up the land value of these prime R-C1 lots. Developers will also be looking for nice corner lots in established single family communities where they can most easily build higher density developments. Stay tuned for higher density 4-plex and 8-plex inventory in your neighbourhood.

SHORT-TERM RENTAL RESTRICTIONS

Short-term rental restrictions could steer buyer demand and investors away from the condo markets. This is intended to increase the stock of longer-term housing options and decrease the appetite for investors to purchase homes that were once attractive only from a short-term investment perspective. The regulations that have already been enacted in many other markets restrict homeowners from renting short-term units that are not their primary residence. Regulators also hope that these investors, once no longer able to make the same return and not looking to rent long-term will bring this inventory back to the resale market and thus increase inventory. If this trend continues which is expected, it could shift buyer intent. Be wary of air-bnb properties as an investment and have a back-up plan.

2024 CALGARY REAL ESTATE MARKET OUTLOOK

Immigration, interest rates and Inventory are the three biggest stories to watch and those that have the largest bearing on the direction of the real estate market in Calgary in 2024. We anticipate inventory levels to remain at historic lows, with pent up demand to offset any decrease in migration this year. Interest rates should start to decline but maybe later in the year than originally anticipated. All markets will perform well, and we could see stronger than anticipated price growth should these three factors work together in a perfect storm of low inventory, stronger than anticipated migration and declining interest rates that instigate higher demand.